ABOUT THE SALVATION ARMY

The Salvation Army (“the Army”) exists to share the love of Jesus Christ, meet human needs and be a transforming influence in the communities of our world.

As an international organization, the Army is at work in 126 countries. In Canada, the Army began its work in 1882 and has grown to become the largest direct provider of social services in the country next to government. In Bermuda, the Army has been at work since 1896.

The Army gives hope and support to vulnerable people every day in 400 communities across Canada and Bermuda. Salvation Army staff and volunteers offer practical assistance for children and families, often tending to the basic necessities of life, provide shelter for homeless people and rehabilitation for people who have lost control of their lives to an addiction. When you give to the Army, you are investing in the future of marginalized and overlooked people in your community.

CHARITABLE STATUS

The Salvation Army is a religious, charitable and not-for-profit organization, registered by the Canada Revenue Agency for tax-deductible contributions. The Army’s territorial headquarters in Toronto, Ontario is the main charity and all other Salvation Army entities are registered as associated charities of territorial headquarters. In Bermuda, the Army is also recognized as a charitable organization.

ABOUT THE FINANCIAL STATEMENTS

The Army’s principal legal entity is The Governing Council of The Salvation Army in Canada, a non-profit corporation established by federal statute. It is the corporate trustee body set up to hold assets and perform contracting for The Salvation Army in Canada. These financial statements present the assets, liabilities, fund balances, revenues and expenses of the Governing Council and all of the entities it controls. All separate incorporated entities are consolidated into these financial statements because they meet the definition of controlled entities for financial reporting purposes under Canadian accounting standards.

In addition to these consolidated statements, many of the controlled entities produce separate financial statements for presentation to local stakeholders, including government agencies, donors, members, and others.

FINANCIAL HIGHLIGHTS FOR THE YEAR ENDED MARCH 31, 2013

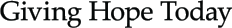

Overall operations were stable in the current year, and the results achieved are similar to those of the prior year, with the exception of the change in investment income. During the year, the Army realized an excess of revenue over expenses of $54 million, compared with $4.4 million in the prior year. The key factor contributing to the increase was higher investment income. Charitable donations increased slightly from $180.2 million last year to $183.7 million. The increase is attributed to a rise in legacy income which fluctuates from year to year.

The operating fund, which represents the general operations of all Salvation Army units in Canada and Bermuda, reflects a surplus of $8.7 million, compared with a deficit of $39.3 million in the prior year. This increase is also directly related to the improved investment income this year. Total operating expenses increased by only 3%, in line with general inflationary pressures. Last year the deficit was offset by transfers from reserves, whereas in the current year a modest amount has been transferred from the operating fund to reserves for future operations.

As of March 31, 2013, the Army’s total assets were $1.54 billion, compared to $1.49 billion in the prior year. The current ratio (current assets/current liabilities) of 0.91 should not be interpreted as meaning the Army will have difficulty meeting its short-term obligations; as short-term investments maturing in less than one year and totaling $35.6 million have been classified with securities. When included with current assets, the current ratio becomes 1.38.

Operating fund balances stood at $113.6 million, compared to $110.8 million in the prior year, or on average, about $237,000 per unit. The Army has set a policy of expecting each unit to maintain an operating reserve sufficient to fund at least three months’ expenses. As of March 31, 2013, approximately 57% of units have achieved the target reserve level compared to 40% in the prior year. Efforts are underway to build reserves in the remaining units within the next four years.

EXECUTIVE COMPENSATION

The compensation package for all commissioned officers of The Salvation Army includes housing accommodation, with furnishings and utilities provided by the Army, a leased vehicle or vehicle allowance, and a cash allowance based on years of service. The cost of compensation provided to senior officers is comparatively lower than that paid to executives in other similar organizations. The employment income for tax purposes reported in 2012 for the five most senior commissioned officers of The Salvation Army in Canada ranged from $33,121 to $44,501, with an average of $37,920.

The size and scope of the Army’s operations creates a level of complexity that requires the hiring of highly skilled professional and technical staff to supplement the skill sets found in its commissioned officer ranks. While these salaries are typically less than comparable positions in the for-profit sector, there is increased competition for professional staff, and as a result, compensation for executives in the sector has increased in recent years.

In 2012, there were 44 non-officer employees whose total employment income for tax purposes was above $100,000. In 2012, the 44 non-officer staff whose salaries were over $100,000 were in the range $100,608 to $259,720 with an average of $136,747.

There is a tension between paying competitive salaries to attract the right people on the one hand, and ensuring that executive compensation does not reach unreasonable levels on the other. This tension is particularly acute in the not-for-profit sector where organizations and donors are both concerned about keeping administrative costs low so as to maximize funds available for direct service delivery. We believe that the Army is managing this tension well.

VOLUNTEERS

In addition to paid staff, The Salvation Army’s operations are aided by some 202,000 volunteers who give dedicated and exemplary service to their communities by helping deliver programs and services through Salvation Army facilities. Whether serving as board members, specialist advisors, food hamper packers, greeters, chaplains, or in a host of other roles, these volunteers are the army behind the Army. The contributions of these volunteers are invaluable to the success of The Salvation Army’s program and service delivery.

RISK

A Risk Committee is in place with responsibility to monitor the direction and trend of all major types of risks relative to mission strategy and market conditions. It also reviews emerging risks to the Army and monitors activities to appropriately mitigate those risks.

INTERNAL CONTROLS

The Salvation Army has a strong internal control environment to protect the Army’s assets and ensure accuracy in financial reporting.

The Territorial Finance Council has overall responsibility for internal controls, with assistance provided by the Internal Audit Advisory Committee as it relates to the oversight of the internal audit function and plan.

In late 2012, the Army became aware of two significant cases of fraud involving executive directors of ministry units in Toronto and Ottawa. Criminal proceedings are underway in both cases at the date of this report. While the nature of these two cases was completely different, there was a common theme in that both involved a person in a management role. The Army has taken steps to tighten controls in the two ministry units concerned, as well as taken the opportunity to review processes and policies in place nationally to ensure that policies are not only robust, but also that there is full compliance across the organization.

Both a Code of Conduct and a Whistleblower Policy have been approved during the last year. The former sets out expectations for behaviour by all staff and volunteers, while the latter provides a mechanism for making anonymous complaints when violations of the code and other key policies are observed.

PUBLIC ACCOUNTABILITY

The Salvation Army recognizes its accountability for the financial resources placed at its disposal by its contributors for the furtherance of its mission to serve the most vulnerable in our society. Donations from the public at large, which includes money from individuals, foundations, corporations and all levels of government, are used for our community and social service programs.

ETHICAL FUNDRAISING & FINANCIAL ACCOUNTABILITY CODE

The Army places accountability at the core of its relationships with its donors and members of the public. The Army has formally subscribed to Imagine Canada’s Ethical Fundraising & Financial Accountability Code. In doing so, the Army undertakes to adhere to the standards set out in the Code in its treatment of donors and the public, its fundraising practices and its financial transparency, and to be accountable for doing so. To review the Code, please visit www.SalvationArmy.ca/fundraisingethics.

FUNDRAISING METHODS AND OUTCOMES

For more than 130 years, faithful donors have helped The Salvation Army carry on its tradition of caring for vulnerable men, women and children in Canada, Bermuda and around the world. The Salvation Army is deeply grateful for their generosity and for the trust they have shown that the Army will use their investment wisely.

During the fiscal year ended March 31, 2013, supporters made donations to the Army totaling $183.7 million, compared to $180.2 million the previous year. Fundraising costs for the same period were $21.9 million, compared to $21.1 million last year.

Overall, 86 cents of all funding revenue received by The Salvation Army (i.e. including government funding, public donations, fees for service, investment income, and net profits from Thrift Store operations) is used directly in charitable activities. This substantially exceeds the Canada Revenue Agency guideline of 65% efficiency.

The Army is committed to protecting the privacy of its donors, customers, clients, volunteers, employees, and members, and is always concerned with treating personal information carefully and with appropriate confidentiality. Personal information is not used or disclosed for purposes other than those for which it was collected, except with consent or as required by law. This information is retained only as long as necessary and the Army does not trade, rent or sell any personal information to third parties.

The Army will accept unrestricted gifts, as well as gifts restricted for specific programs and purposes, provided that such gifts are not inconsistent with its stated mission, purposes, and priorities. Gifts may be restricted to specific Salvation Army programs/purposes or communities throughout Canada and around the world where the Army has established operations. After a gift has been accepted, if circumstances should at any time make it, in the view of the Army acting reasonably, impractical to apply the gift to the designated purpose, it may re-designate the purpose of the gift using its best efforts to adhere as closely as possible to the original intent of the gift. Where possible, The Army will seek input from the donor before the re-designation is made.

The Salvation Army is managing its fundraising costs in a reasonable manner, in order to provide the best programs and services that deliver transformative outcomes for the people we serve. For details of how the funds are used, please visit www.SalvationArmy.ca.

HOW EFFICIENT IS OUR FUNDRAISING AND ADMINISTRATION

Much attention is focused today on the fundraising and administrative costs that charities incur, with the message carried in the media that the lower these costs are, the better the charity is at delivering its programs and services.

The Army agrees the more efficient an organization is, the lower its overall costs of fundraising and administration will be; and as a result, more funds will be available for charitable programs.

These financial statements reveal that in the year ended March 31, 2013, the Army’s total administration costs incurred at its territorial and divisional headquarters amount to $33.4 million, compared to $33.1 million in the prior year, an increase of 0.9%. As a proportion of total funding sources (see pie charts Facts and Figures page), headquarters operations represented 5.8% this year and 6.5% in the prior year.

Public relations and development costs increased 3.7% from the prior year. As a proportion of charitable donations, these costs represented 11.9%, compared with 11.7% in the prior year. This compares favourably with the upper limit of 35% set by the Canada Revenue Agency.

The Salvation Army believes this is the best measure to use at the present time to evaluate the efficiency of fundraising, recognizing that it does have some limitations. First, no donations of materials or services are included in these financial statements, even though costs are incurred in obtaining these donations. Second, as the name implies, some of the activity these costs represent relates to general marketing and communications functions, rather than fundraising activities. Given our holistic approach, it is not possible at present to provide any further breakdown.

Combined, fundraising and administration costs equal $55.3 million, compared to $54.3 million in the prior year. As a proportion of total funding sources (see pie charts Facts and Figures page), these costs amount to 9.7% in the current year and 10.6% in the prior year.

The Salvation Army believes that it is managing its administrative and fundraising costs in a reasonable manner given the size and scope of the organization, and that it is ensuring the maximum possible return on that investment in order to provide the best possible programs and services that result in transformative outcomes for the people we serve.

MANAGEMENT RESPONSIBILITY FOR FINANCIAL REPORTING

These financial statements are the responsibility of management. They have been prepared in accordance with Canadian generally accepted accounting principles for not-for-profit organizations as established by the Accounting Standards Board of the Canadian Institute of Chartered Accountants.

The preparation of financial information is an integral part of the ongoing management of the Army. Management has established internal control systems to ensure that all financial details are objective and reliable, and that the organization’s assets are safeguarded.

The Governing Council has overall responsibility for the financial statements, assisted by the Territorial Finance Council, which meets regularly with management as well as internal and external auditors to ensure the adequacy of internal controls, and to review the financial statements and auditors’ report. The Governing Council appoints the auditors and approves the financial statements, based on a recommendation from the Territorial Finance Council.

The financial statements have been audited by external auditors KPMG LLP, Chartered Accountants. Their report outlines the scope of KPMG’s examination as well as their opinion on the financial statements.

Neil Watt, Lt. Colonel

Territorial Secretary for Business Administration and Treasurer of The Governing Council

R. Paul Goodyear, MBA, CMA, FCMA

Territorial Financial Secretary and Secretary of The Governing Council

Click here for a downloadable PDF of the 2012/13 Annual Review.

Click here for a downloadable PDF of the 2012/13 Consolidated Financial Statements.