Salvation Army Virtual Tax Clinic Helps People Navigate Through Tax Season with Ease

Tax season is a stressful time for many people. It can be overwhelming to ensure that all your documents are in order, and hiring a professional to assist you can cut a significant chunk of your tax return. Fortunately, The Salvation Army has several locations across Canada that offer accessible tax clinics to help you file your taxes accurately and at no cost.

The Salvation Army in Oshawa, Ont., offers a virtual clinic that allows clients to get everything done from the comfort of their own homes. To be eligible for this program, you must be an individual who earns no more than $35,000 or a couple earning a combined income of $45,000 or less, plus $2,500 for each additional member of their immediate family.

Volunteer Coordinator of the Income Tax Clinic, Lori Armstrong, explains the importance of this initiative.

“It helps people on low incomes save money.”

“I think this is a great program because there are people fearful of doing their taxes, and it helps people on low incomes save money. They’re filing their taxes, which they need to get done to get their child’s tax benefit, GST credit, carbon tax credit and their Ontario Trillium credit. Clients are entitled to all these credits, which add up to a fair bit of money needed for essential items,” Lori said.

The Salvation Army’s Income Tax Clinics are officially recognized by the Canada Revenue Agency (CRA), through their Community Volunteer Income Tax Program (CVITP). The tax preparers who work with the clients at the Oshawa tax clinic are trained and experienced. This year, four tax preparers will be available to assist.

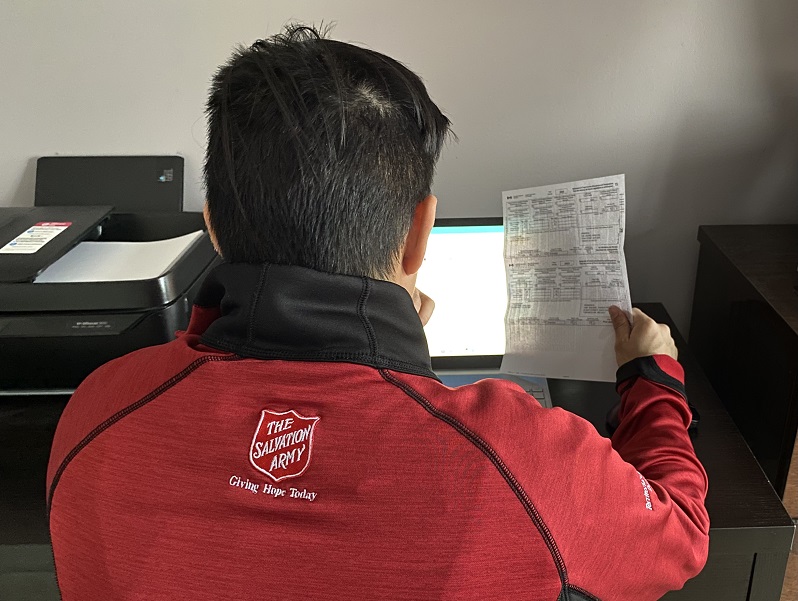

Since the pandemic, the tax clinic in Oshawa has become fully virtual. This format makes the process of filing taxes more efficient. Lori gets in touch with the clients, letting them know what documents the preparers need to proceed. Once clients send their tax slips, the preparers take care of all the filing.

“They are very thankful to get their taxes done and get the refund or the tax credits they are entitled to.”

“When the pandemic hit, we took it remotely through our website and it has remained a virtual clinic. It is all done for them by the tax preparer. Before, they used to come and sit across the table with all their stuff. If they came to the tax clinic, and they didn’t have everything with them, then we would have to make an appointment for them for another night. So, in that respect, this is easier,” Lori added.

According to Lori, clients who come to the clinic leave happy with the assistance they receive.

“There are lots of very grateful people. They are very thankful to get their taxes done and get the refund or the tax credits they are entitled to,” Lori shared.

Becky has used the clinic’s services multiple times. After going through a separation, she found herself needing some assistance with her taxes. A friend from her church suggested she join the clinic. Since then, Becky’s stress when it comes to tax season has decreased significantly.

“My experience has been a very positive one. They were quick, helpful, and easy to work with. I got my return in great time, and it was always more than I anticipated,” Becky said.

In addition, not having to hire someone to file her taxes, allows her to save some more of her income for her family.

“I’m very thankful for the clinic’s help and I’m glad they provide this service. The money I save using this service allows me to take my kids to do something fun every summer,” she shared.

By Juan Romero