Free Tax Clinics Relieve Stress and Boost Income for Struggling Canadians

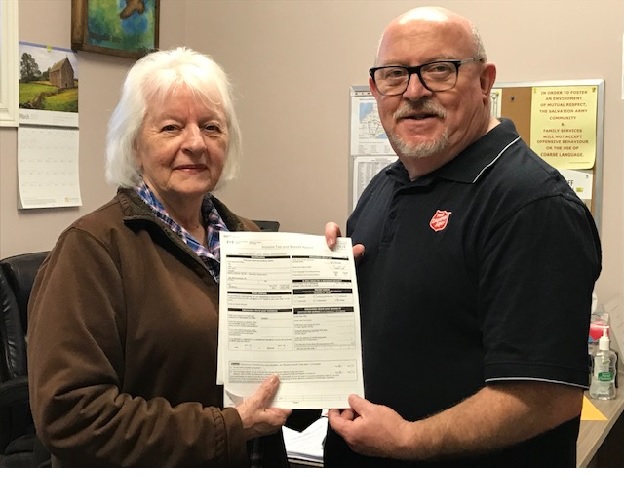

With one in 10 Canadians living in poverty, tax season can be a stressful time. For people such as Carole and her son, Troy, The Salvation Army’s free income tax clinics not only encourage low-income individuals and families to fill out their taxes, but the process can help to improve many difficult situations.

“Carole has a number of physical health concerns and Troy, her adult son, suffers with mental health issues,” says Captain Danette Woods in Saint John, N.B. “Without this service, they simply wouldn’t get their taxes done and may miss out on benefits.”

The Salvation Army in Saint John is located in an extremely low-income neighbourhood, with more than 1,000 people benefitting from the Community Volunteer Income Tax Program (CVITP), a partnership between Revenue Canada and The Salvation Army.

Last year, The Salvation Army across Canada helped 9,500 people with income tax and budget assistance.

“People who come to the clinic might be living on the streets, in inadequate housing or relying on food banks for meals. They just can’t afford the $80 to have their forms completed by an outside company,” says Jerry, volunteer coordinator.

Jerry says that many visitors are unaware of the different tax credits available to them or know how to apply for them. At the clinic they learn about benefits that, cumulatively, can add up to thousands of dollars of additional income. These include the Canada Child Benefit, Old Age Security, solidarity tax credit and GST/HST.

“This service was the best thing that could be done for me,” says Carole. “It was so helpful and I’m very grateful to The Salvation Army and its partners for offering the program.”

Last year, The Salvation Army across Canada helped 9,500 people with income tax and budget assistance.