Free tax program now a drop-off service due to COVID-19

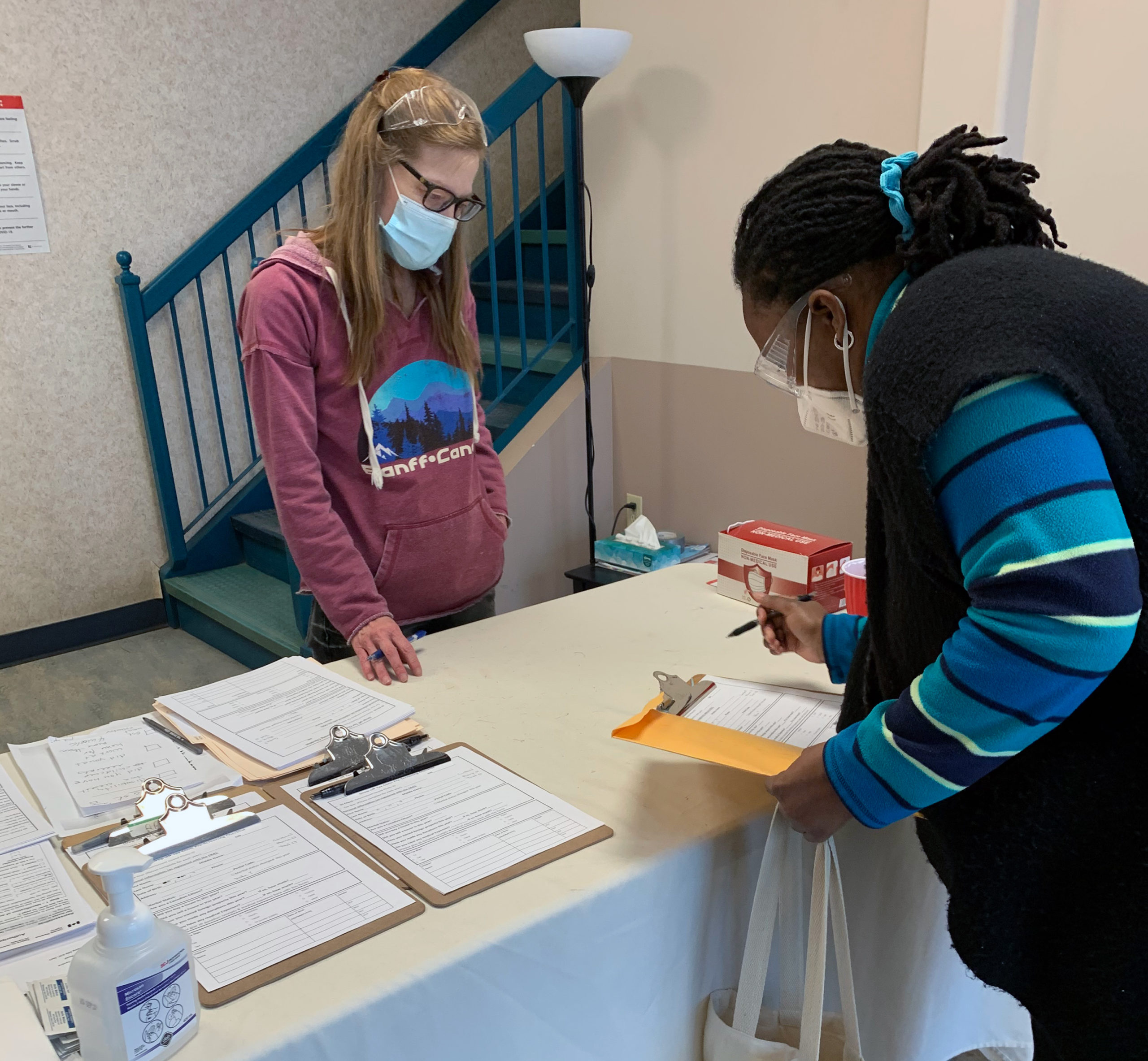

The Salvation Army’s Centre of Hope (COH) in Edmonton is once again hosting its annual free drop-off tax clinic for low-income earners, but with some added safety measures due to COVID-19. Instead of coming in to have their return completed, people now use the drop-off service where recipients can pick up their completed returns. The Community Volunteer Income Tax Program (CVITP) is a collaboration between community organizations, such as The Salvation Army, and the Canada Revenue Agency (CRA).

“The tax clinic is beyond just doing taxes,” said Sarah Edwards, Special Events Coordinator for the Edmonton Centre of Hope. “We may have a senior come in and we notice they are eligible for CPP, but are not receiving it. We would then help the individual find the right form and help them fill it out.”

Since 1971, the program has been helping individuals and families in need by preparing their income tax and benefit returns. To qualify to receive help, a person must meet the eligibility requirements as a low-income earner:

Family Size Total income:

1 person – $40,000

2 persons – $50,000

3 persons – $52,500

4 persons – $55,500

(+$2500 for each additional person)

Community organizations throughout Canada operate on a volunteer basis to host tax preparation clinics and prepare income tax and benefit returns for eligible individuals within their community.

The Salvation Army’s COH has many volunteers with different career backgrounds. Most of them are retired, but others have either worked for the CRA, or are civil servants, students, or former members of the community.

“They may have a connection to The Salvation Army through family, friend, or themselves,” explains Edwards. “The CRA provides online training for folks who want to learn the software.”

Volunteers are crucial to the program succeeding as Edwards added,”the need for tax support surged during COVID-19 as it was a requirement to have your most recent tax year done to be eligible for COVID-19 benefits.” Additionally, the program helps vulnerable individuals navigate benefits like Employment Insurance, the Canada Pension Plan, Old Age Security, Guaranteed Income Supplement, social assistance, worker’s compensation, child benefits, annual income tax returns, and tax-related credits.

Last March, the tax-clinic was shut down after one week. The program carried on at the Expo centre with the help of other agencies, serving approximately 675 Edmontonians a day during the pandemic.

“All of these transactions play a significant role in the financial lives of our clients,” explains Edwards. “These systems and benefits only work well when target beneficiaries are aware of them and understand how and when to access them.”

The free tax clinic is open from March 1 to April 30 at 9618 101A Avenue. For information about hours or eligibility call 587-920-7450.